Planning Budget: In this planning budget we just plan the expenditures but there will not be any control over it. It's is prepared for comparing the actual with budget figures to know the variance.

Funding Budget: In this funding budget we can plan the expenditure or Revenue and also we can keep the control on budget journal amount. Here, we required to create budget journal for defining budget amount. It will control the actual transaction by using fund check methods(None, absolute, Advisory).

PlanningControlBudget JournalPlanningYNNFundingYYY

1. Open

2. Current

3. Freeze (Close)

First period in the organization is with current Status when define the budget next time you will get only Open Status. Freeze Status means closing of the budget.

Fund Check levels: There are three types for fund check level.

None - It is for planning budget

Absolute - We can’t enter amount beyond the budget amount.

Advisory – It will pop up a warning message when we enter amount beyond budget amount.

Setup Steps:

1. Create Reserve for encumbrance account and expenses accounts in account segment values

2. Enable budgetary control at Ledger

3. Define Budget

4. Define Budget organization

5. Create Budget Journals

6. Query the budget journals and post

7. Create journal entry using budget account and test it.

Let us see, how to configure setup steps for funding budget

Step 1: Define Reserve for encumbrance (Ownership) A/c at account segment level.

Step 2: Enable Budget control at ledger Level.

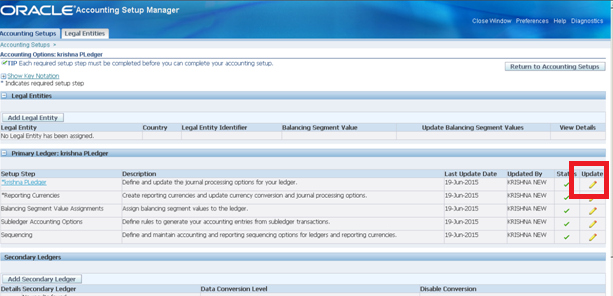

Navigation: Setup --> Financial --> Accounting Setup Manager

--> Accounting Setup.

Query your ledger and click on Update accounting options

Query your ledger and click on Update accounting options

Go to primary ledger region and click on Update

Now go to Advance Option window and fill budgetary control regions details like

Enable Budgetary Control

Enable Budget Journal

Enter Account code combination for Reserve for encumbrance.

Enable Budgetary Control

Enable Budget Journal

Enter Account code combination for Reserve for encumbrance.

Now, click on Finish and check for the Confirmation note.

Step 3: Define Budget.

Navigation: Budget --> Define --> Budget.

Enter Budget name and description

Enter Budget name and description

Choose your Ledger

Status: Current

Enable check box “Require budget Journals”

Choose Budget periods: First and Last

Click on “Open Next Year”

Note: Now, Query the Budget and you can see last open year field is updated.

Step 4: Define Budget organization.

Using these Budget organization form we can define name of the budget and descriptions and choose the display sequence and Set password (Optional) and also used to mention accounts

which are using for budget planning and Budget control options.

Navigation: Budget --> Define --> Organisation.

Name your Budget Organization & Description

Choose ledger

Select Ordering segment

Choose Display Sequence

Enter Effective dates

Click on "Ranges" button

Enter Line: 1

Choose Accounts for Low and High

Type: Entered

Currency: INR

Now Status is adding

Click on “Range Assignments” and Choose Accounts individually

Close this window & Click on “Budgetary Control” button

Step 5: Create Budget Journal.

Navigation: Budget --> Define --> Journal.

Choose “Budget organization”

Review Journal

Now, Post all unposted budget journals

Now, Let's test the budget concept by entering more than Planned amount.

System displayed a note message stating that this transaction failed fund check. It means we can't post this journal. We need to enter amount less than the budget/Planned amount.

Note: To Check the funds availability Navigate to Inquiry --> Funds window.

Choose “Budget organization”

Choose “Accounting periods”

Go to “Work sheet mode”

Choose Accounts period from and to

Select one by one account

Say "Apply".

Note: You have do the same for all accounts

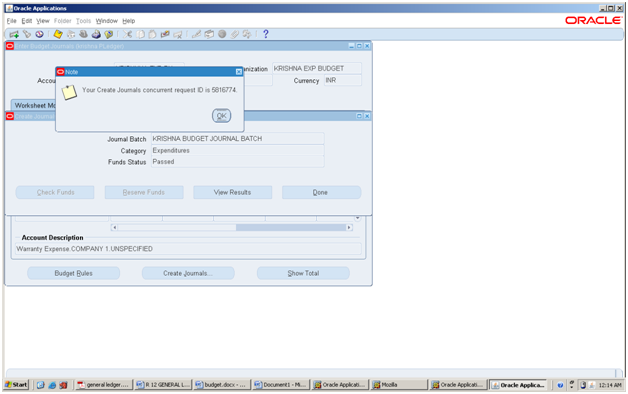

Now click on "Create Journal" button

Enter Journal Batch name

Choose Category: Expenditures

Funds status: Required

Click on “Check Funds”

Click on “Reserve Funds”

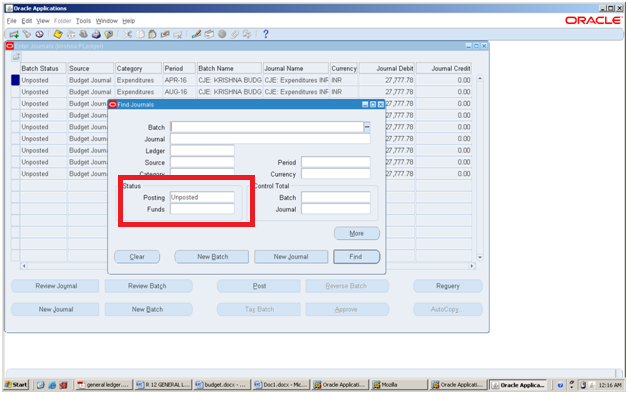

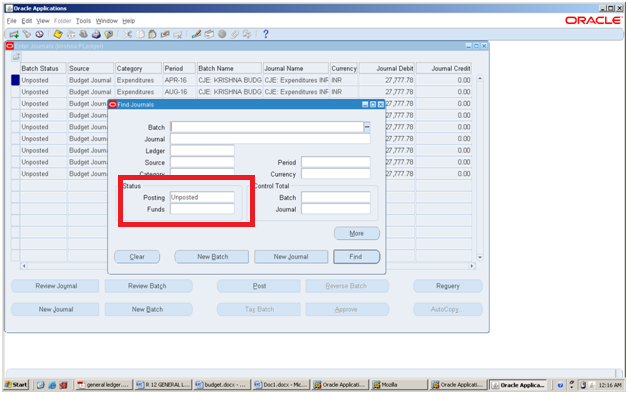

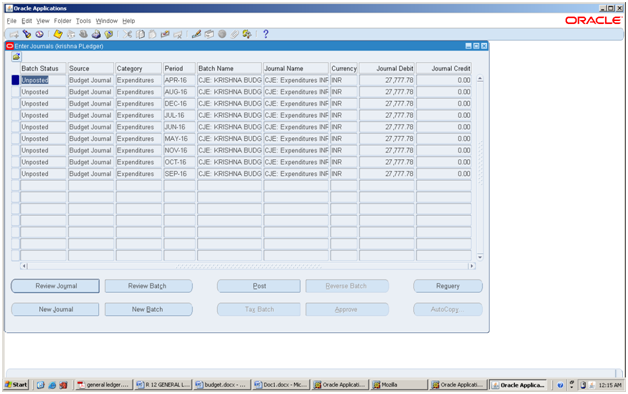

Step 6: Query

the Unposted budget journals and post

Navigation: Journals --> Enter.

Choose Status Posting as " Unposted" and click on find button

Choose Status Posting as " Unposted" and click on find button

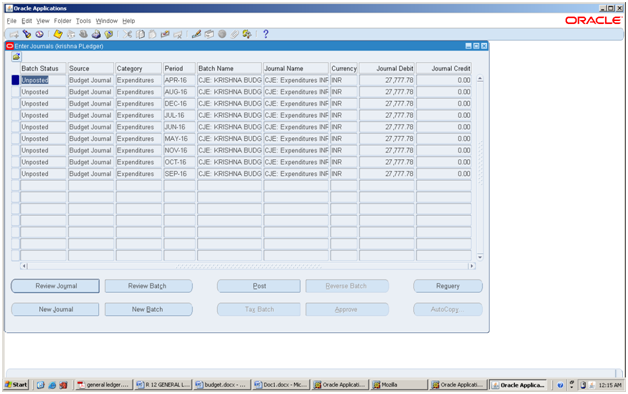

See the unposted budget journal.

Review Journal

You can see:

Journal name: CJE

Balance type: Budget

Only debit lines created in journal entry Now, Post all unposted budget journals

Post the Journal entry

Go to View --> Request

Ensure Journal posting program completed normalNow, Let's test the budget concept by entering more than Planned amount.

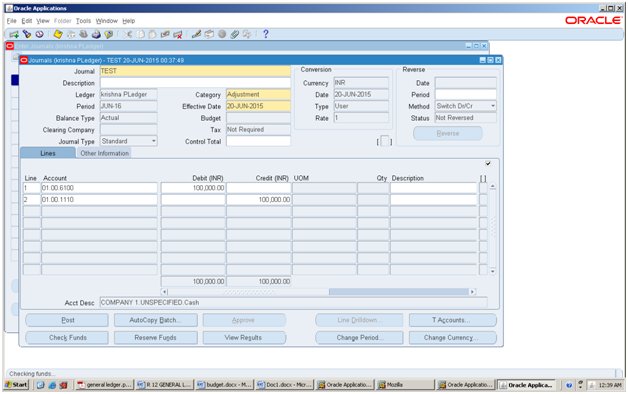

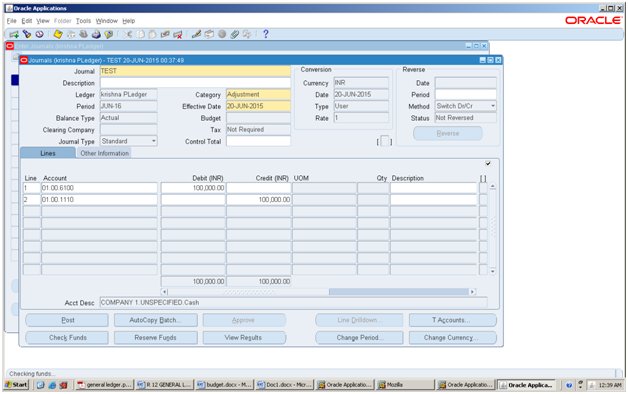

Step 7: Create

Journal entry using budget account

Navigation: Journals --> Enter

Say “new Journal”

Category: Expenditures

Click on "Check funds"

System displayed a note message stating that this transaction failed fund check. It means we can't post this journal. We need to enter amount less than the budget/Planned amount.

Note: To Check the funds availability Navigate to Inquiry --> Funds window.